It has been just over one year since the implementation of the GST law. And during this period, we have witnessed various amendments, deferments, exemptions, clarifications, notifications, circulars and so on and so forth.

Reverse Charge Mechanism under GST is no exception to these changes. Let us understand the journey of

Under the GST law, if the levy of tax is in the hands of the recipient of goods and services, it is called as tax under Reverse Charge Mechanism. That is, the responsibility of the payment of tax is on the recipient of the goods and services.

ABC Private Ltd is a registered under GST. ABC Private Limited avails some legal services from an advocate, X, who is not registered under GST. X raises an invoice on ABC Private Limited for Rs.10,000 (without any GST). ABC Private Limited is liable to pay a GST @ 18% on Rs.10,000 = Rs.1,800 to the Government. ABC Private Ltd though is a recipient of service, is liable to pay GST on the legal services. This is termed as Reverse Charge Mechanism.

Section 9(3) and Section 9(4) are the two sections covering GST under RCM.

Section 9(3) – The government may, on recommendations of the Council, by notification, specify category of supply of goods or services or both, the tax on which shall be paid on reverse charge basis by the recipient of such goods and services or both.

Section 9(4) – Tax on the supply of goods or services or both by an unregistered supplier to a registered supplier shall be paid by the recipient of such goods or services or both.

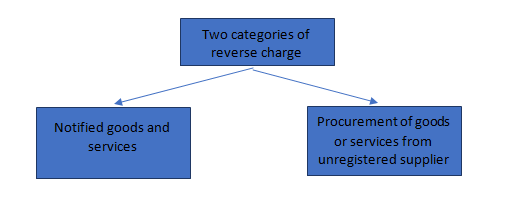

From the above sections, it is clear that reverse charge mechanism is of two categories:

The following are the goods and services notified by the Government, on the recommendation of the council, which attract GST under reverse charge mechanism:

For further details (like service provider/supplier, recipient of such goods or services, rate of tax etc.) on the notified goods and services, please refer the respective notifications issued by the Government.

Goods:

Services:

Similar notifications are available under Integrated tax and Union Territory Tax.

If any registered person procures any goods or services from unregistered person then the registered person is liable to pay GST under RCM.

Currently, the GST under RCM for procurement of goods or services or both received by a registered person from unregistered supplier is exempted till 30 September 2019.

The following were the amendments made vide various notifications to this section:

The Central Government, on recommendation received from the GST council, exempted intra-state supply of goods or services or both, received by a registered person from unregistered supplier from GST under RCM upto Rs.5000 per day effective from 1 July 2017.

The GST under RCM for procurement of goods or services or both received by a registered person from unregistered supplier exempted till 31 March 2018.

The GST under RCM for procurement of goods or services or both received by a registered person from unregistered supplier exempted till 30 June 2018.

The GST under RCM for procurement of goods or services or both received by a registered person from unregistered supplier exempted till 30 September 2018.

The GST under RCM for procurement of goods or services or both received by a registered person from unregistered supplier exempted till 30 September 2019.

As per section 24(iii) of CGST Act, any person who is liable to pay GST under RCM should obtain compulsory registration under GST irrespective of whether his aggregate turnover is below Rs.20 lakhs in a financial year (or Rs.10 lakhs in special category states) or he is a supplier of exclusively exempt or non-taxable goods or services.

GST has to be paid at the applicable rate for such goods or services under RCM.

The due date of payment of tax under RCM depends on the time of supply of goods or services.

On the basis of the invoice raised in accordance with the provisions of the Act, the registered person is entitled to avail Input Tax credit thereof subject to the other provisions of the act and rules relating to Input tax credit.

All provisions of the Act such as collection, recoveries, penal provisions etc are applicable to the recipient.

Payment of GST under RCM has been deferred by the Government till 30th September 2019.

A very common misunderstanding prevailing amongst the tax payers is that the GST under RCM mechanism has been deferred in entirety till 30th September 2019. Hence there is no liability of GST under RCM.

It should be noted here that only RCM under Section 9(4) dealing with procurement of goods or services by registered dealer from unregistered dealer has been deferred till 30th September 2019. However, RCM under Section 9(3) dealing with procurement of notified goods or services still continues to attract GST liability under RCM.

Is GST under RCM is applicable only on services?

No. GST under RCM is applicable on notified goods and services. However, Government on recommendation of GST council has notified very few goods which attract GST under RCM. Thus such notified goods also attract GST under RCM.

Is Partial reverse charge is applicable under GST i.e only a certain percentage of GST is payable under RCM?

No. There is no partial reverse charge applicable under GST. 100% GST will be paid by the recipient if RCM applies.

GST is paid under RCM in a particular month. Can ITC on the same be availed in the subsequent month only?

GST is paid under RCM in a particular month. Can ITC on the same be availed in the subsequent month only?

Hence, GST under RCM should be first paid in a particular month and then the same can be availed as ITC in the same month.

GSTR 3B return allows the GST paid under RCM in a month to be availed as ITC in the same month.